What to do with your lockdown savings?

- 4 MINUTES READ

Everyone’s experience has been different in handling the course of the pandemic and managing money. The consumer response has greatly changed during this situation.

A series of lockdowns around Australia resulted in closures of businesses and some even leading to job losses which created serious unforeseen tension on the financial situations of many Australians. For those that were fortunate, the lockdown enabled them to fatten their wallets amidst the Covid-19 pandemic which helped many Aussies boost their savings.

With so many of us stuck at home and international travel restricted, many Australians dropped their spending dramatically and resulted in making their bank account swell and increase their savings. As a result Australians have saved some $60 billion a year in cancelled overseas travel.

In the year to June 2019, Australians 15 years and over spent $62.3 billion on international travel or an average of $3,115 per person. From early 2020 household savings climbed by more than $112 billion during the year to November. The pandemic-enforced penny-pinching has placed the household savings ratio (the rate of savings to income) at 18.9%, up from less than 5% prior to COVID’s arrival. This situation has given some buyers opportunities to use their extra savings to get into the property market for the first time or move to a lifestyle destination or investment property.

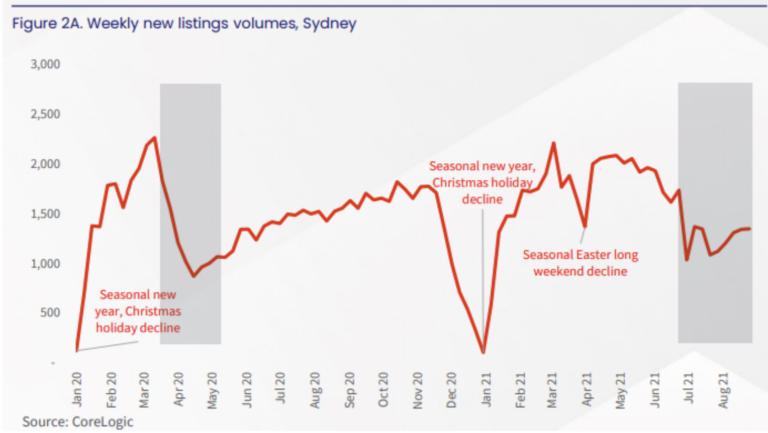

Through lockdown in 2020, the accumulated household income skyrocketed to 21.6% through the June 2020 quarter and remains elevated. In November the cash rate was set to a record low of 0.1% and there was a continued decline in the cost of debt. Lockdowns in Sydney have also seen a much milder decline in employment levels, with the number of people employed falling -0.9% across NSW over July 2021, as opposed to -5.9% through April 2020.

AUSSIES CHANGE OF HABIT DURING PANDEMIC

The sudden onset of the pandemic provided an opportunity to establish better financial practices. Australians cut down on non-essential expenses reducing their overall spending and became more mindful about where they spend their money.

Dining out and any number of purchases delayed due to many stores being closed, online shopping became the new normal and almost always the only alternative to purchasing during the pandemic.

Australians persisting with new shopping habits are more likely to switch to less expensive and cost effective products. Aussie millennials break the “slacker” stereotype and found that millennials positively changed their spending habits. They have reduced their expenses and optimised their savings by actively taking steps to manage their finances during Covid-19.

Having a high level of awareness toward their spending increased their savings rather than debt. Many took the time to research to secure better home loan deals and others put that new-found cash towards their property deposit.

HOW ARE PEOPLE SPENDING THEIR SAVED MONEY NOW?

With many only now being able to physically enter stores in person, the demand for contactless payment or cashless payment methods have shifted Australians to continue to online shop to purchase what they need.

Around 58% of Australians will do the majority of their Christmas shopping online this year to avoid the crowds and a similar proportion (60%) expect to do more of their shopping online even after all COVID-19 restrictions ease and things go back to “new normal”. The integration of digital purchases into Australians’ lives is also expected to continue 76% Gen Z, 78% Gen Y cf. 61% Gen X, 34% Baby Boomers, 24% Builders are likely to do shopping online . Even though Australians made a major shift on shopping it doesn’t hinder the fact COVID-19 became a wake-up call for many Australians it has been a time of reflection and re-evaluating what is important to them.

HOW AUSTRALIANS ARE RE-EVALUATING THEIR FINANCIAL WELL-BEING NOW?

This pandemic only highlighted the importance of having additional cash to help cover expenses in case of emergencies. Australians have been looking for additional sources of income to give them a sense of security and financial assurance.

While many people may have savings now, it is not a wise financial move to spend all your savings on shopping but instead use your savings to start building your wealth.

Many Australians are moving forward by investing their savings in property as a new pathway to generate monthly cash flow and become financially independent in the future.

Everyone’s experience has been different in handling the course of the pandemic and managing money. The consumer response has greatly changed during this situation.

A series of lockdowns around Australia resulted in closures of businesses and some even leading to job losses which created serious unforeseen tension on the financial situations of many Australians. For those that were fortunate, the lockdown enabled them to fatten their wallets amidst the Covid-19 pandemic which helped many Aussies boost their savings.

EMBRACE OPPORTUNITIES INVESTING IN PROPERTY OFFERS

Covid-19 left an indispensable mark on everyone.

Now is the time for us all to re-evaluate our goals and realize where we are heading in the future. Australia’s response during the pandemic has set the market up to rebound strongly in 2021. The real estate market continues to gain momentum making it a good vehicle to generate wealth and many young investors are embracing the opportunities that investing in property offers and with the right strategy and expert guidance, delivers a consistent result, long-term gain, security, and stability.

Your complimentary strategy session

So, if you have your savings and you are not sure how to invest but you want to start building your wealth, getting started in real estate can be an option as there are many opportunities to explore. Our team will work with you 1-on-1 to firstly understand your financial situation then create a tailored investment plan specifically towards your future goals. Speak with a dedicated property consultant today and discover how we can get you started on this journey.